Financial Training for NAD Pastors on the Way

A $1.25 million grant from the Lilly Endowment will fund NAD financial literacy programs and initiatives.

by Edwin G. Romero

We are excited to announce that the North American Division Adventist Retirement Plans and Ministerial Association has received a $1.25 million grant from the Lilly Endowment for programs and initiatives aimed at enhancing our pastors' financial literacy and wellness. Our purpose is to help pastors develop financial skills, reduce their debt, invest in their retirement, alleviate financial stress, and become more effective ministers and church administrators. We genuinely care for them and want them to feel supported.

Here are some of our goals in greater detail:

Increase financial literacy of pastors across North America

Create an awareness of financial principles

Reduce pastors’ stress about money

Support our pastors in tangible ways: Our motto is “With you on the journey.” We want our pastors to know they are not on their own when it comes to financial wellness.

Create an awareness among church leadership of the current financial challenges pastors encounter

Make answering the call to ministry more feasible and attractive to potential pastors

Share our experience and knowledge with other denominations receiving the Lilly grants

We believe these initiatives will make a career in ministry more appealing to students who feel called by God. Additionally, pastors will be able to look forward to a well-funded retirement. The NAD Ministerial Association and the Retirement Office will implement strategies to ensure the sustainability of these programs beyond the duration of the Lilly Foundation grant.

Targeted Training and Resources

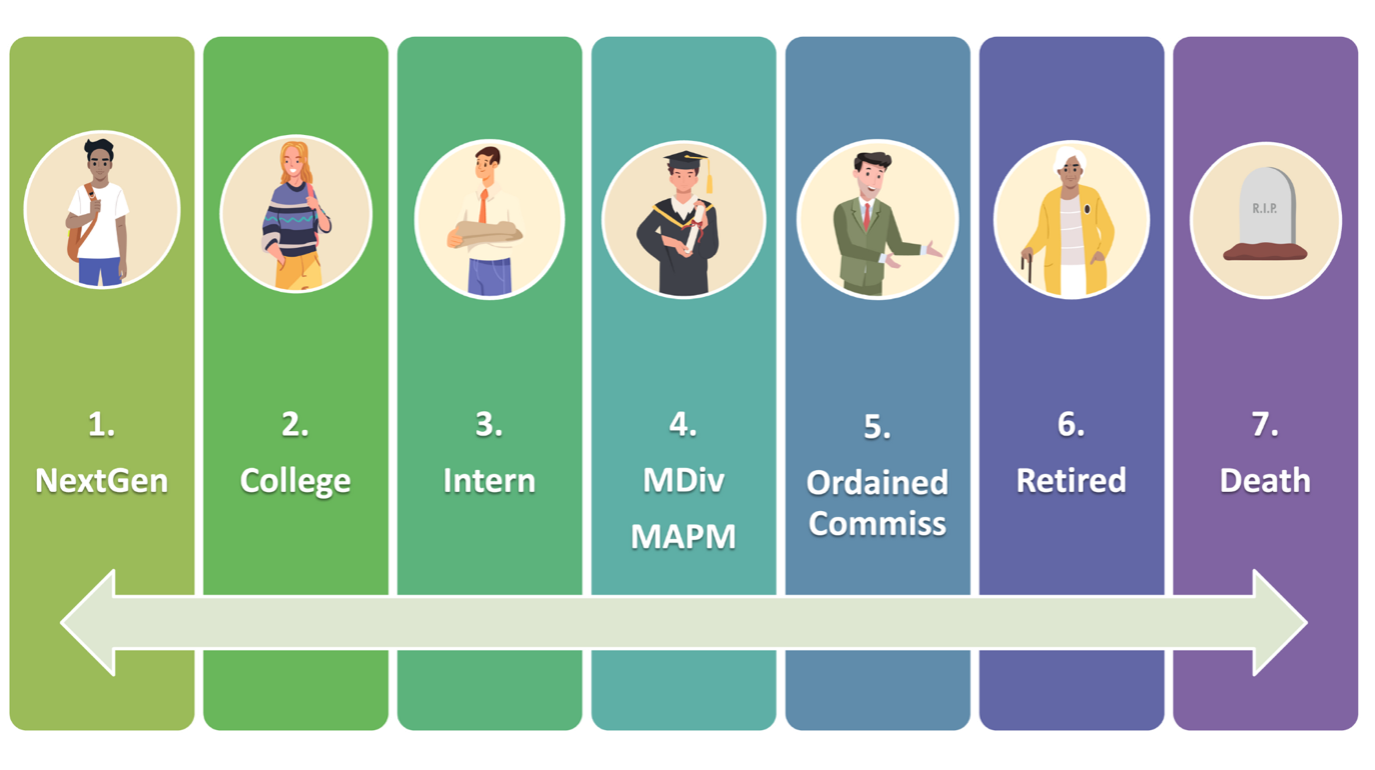

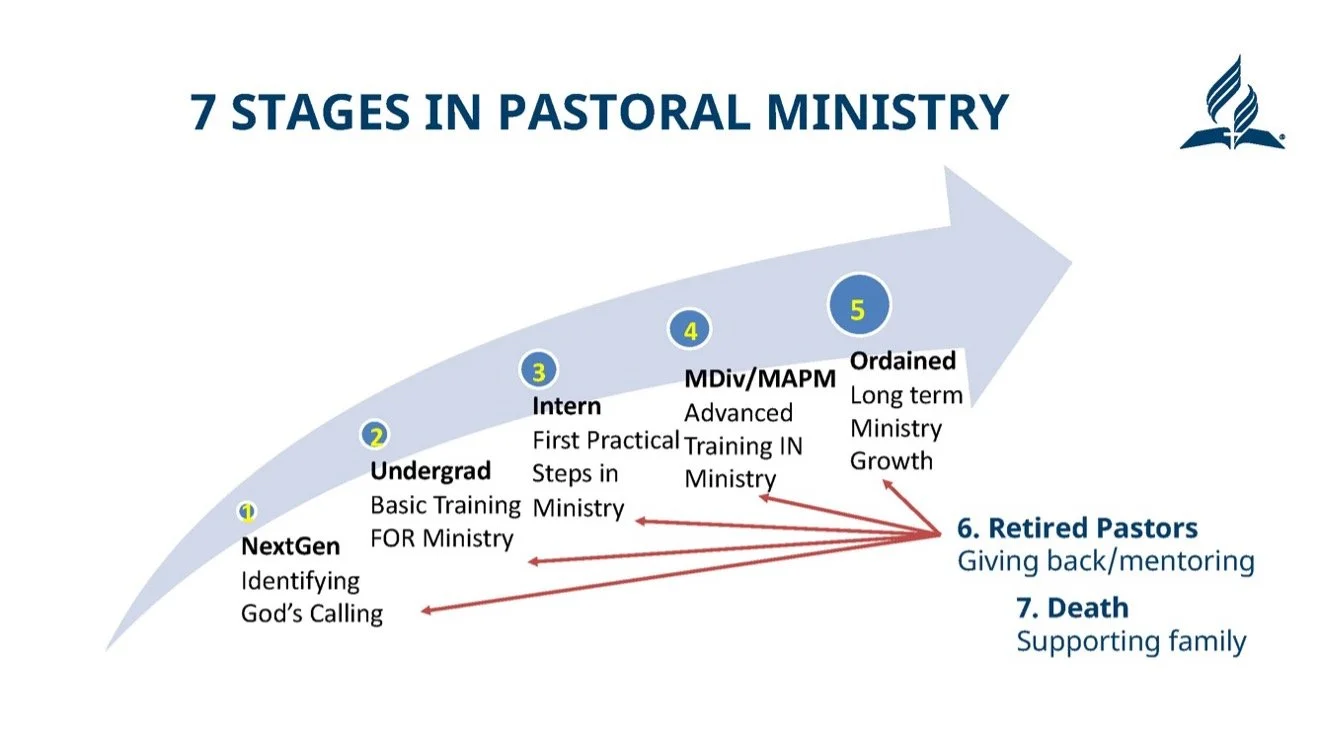

At a January 2024 ministerial resource advisory meeting, leaders identified seven stages in the life of a minister (Figures 1, 2). We aim to tailor training and support to meet the targeted needs of each group to maximize effectiveness.

Figure 1.

Figure 2.

Targeting resources and education to the specific stages in the career of our pastors will allow us to help early and mid-career clergy learn how to set up and keep to a budget, pay for school, and begin investing early to gain the benefit of compound interest. We can help seasoned pastors prepare for higher costs of healthcare and for retirement.

Educational Programs and Services

To the extent possible, we will tailor our programs, services, and initiatives to a target audience (age, stage of career, or other demographic for maximum engagement and effectiveness). Here are the main projected initiatives:

Financial Coaching: That is, personal coaching via a Certified Financial Planner™ as well as group coaching through in-person and Zoom workshops that include resources and a Q&A period. Participants are provided with presenter contact information for follow-up questions.

Financial Wellness Retreats: We will add a day or two of financial wellness seminars to retreats already planned for pastors by conferences and other organizations. This will minimize the extra costs for travel and lodging compared to stand-alone retreats. Training includes topics such as budgeting, debt reduction/elimination, tuition, emergency funds, and retirement planning.

Pastor Summit: This will be an annual one-day NAD-wide financial wellness and tax intensive for pastors. It will be conducted both in-person and virtually.

Called Pastors’ Convention, July 26-29, 2027: We will have a booth in the exhibit hall, a late night café on financial topics, Certified Financial Planners™ (CFP’s) onsite to meet one-on-one with attendees, plus breakout seminars on financial wellness topics.

Masterclasses on the Adventist Learning Community Virtual Platform: One class will be for theology students and the other will target employed pastors.

Microlearning Videos: We will create short 15-20 short, 2-5 minute videos on relevant financial topics.

App for Pastors: We will create an app for pastors to make it easy for them to access financial wellness information, network, and ask questions. The app will make it easy for us to push helpful news and tips to them.

Podcasts: We are excited about offering podcasts that feature financial experts to share personal finance information in an engaging, useful, and entertaining format.

Onboarding Platform: The need for this is apparent. Developing an interactive onboarding educational platform that can be used across the NAD by human resources for training new pastoral employees will ensure everyone is exposed to necessary information in a consistent manner. New employees will learn about the retirement matching program, parsonage allowance, and other financial benefits they may be eligible to receive.

We are looking for the following outcomes:

Increased financial literacy and financial wellness among pastors

Reduced stress and tension about money matters

Increased pastor retention

Increased retirement readiness among pastors

Increase in students pursuing a theology degree and career in pastoral ministry

Pastor Edwin G. Romero is the Chief Executive Officer and Administrator for the North American Division Adventist Retirement Plans, as well as an associate treasurer for the North American Division.